The relentless march of technological advancement dictates a future where digital assets permeate the very fabric of our global economy. Bitcoin, the progenitor of this revolution, stands as a testament to the power of decentralized finance. But the path to securing these digital riches isn’t paved with ease; it’s a demanding landscape shaped by escalating mining difficulty and the ever-elusive promise of profitability. What awaits the diligent miner in 2025? This article delves into the projected landscape, exploring the interplay of key factors influencing Bitcoin mining and profitability, while touching upon the wider crypto ecosystem.

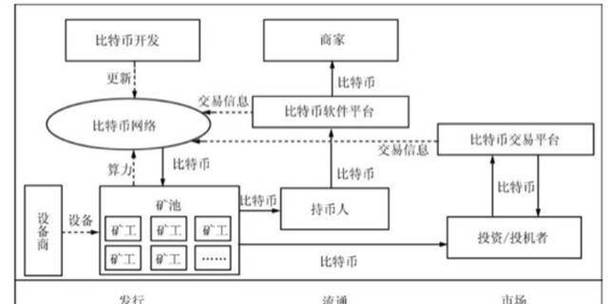

Bitcoin mining, at its core, is a computationally intensive process. Miners deploy specialized hardware, often referred to as mining rigs, to solve complex cryptographic puzzles. The first miner to successfully solve a puzzle gets to add a new block to the blockchain and is rewarded with newly minted Bitcoins, along with transaction fees. This reward incentivizes miners to maintain the integrity and security of the network. However, as more miners join the network, the difficulty of these puzzles automatically adjusts upwards. This dynamic adjustment ensures a consistent block creation rate of approximately one block every ten minutes. This inherent characteristic, known as Bitcoin’s mining difficulty adjustment, forms the crux of understanding future profitability.

Predicting Bitcoin’s mining difficulty in 2025 is akin to gazing into a crystal ball, fraught with uncertainties. Several factors will undoubtedly play a significant role. The price of Bitcoin itself is a paramount driver. A sustained bull market, attracting a surge of new miners eager to capitalize on higher rewards, would inevitably lead to a significant increase in difficulty. Conversely, a prolonged bear market might force less efficient miners to shut down their operations, potentially easing the difficulty. The development and adoption of more energy-efficient mining hardware also influences the equation. If a revolutionary new ASIC (Application-Specific Integrated Circuit) miner hits the market, boasting significantly higher hash rates while consuming less power, the mining difficulty would likely surge as miners upgrade their equipment to remain competitive. Furthermore, regulatory pressures and shifts in geopolitical landscapes, particularly concerning energy sources and environmental concerns surrounding proof-of-work blockchains, can dramatically impact miner participation and, consequently, difficulty.

Beyond Bitcoin, other cryptocurrencies, like Ethereum (ETH), have explored alternative consensus mechanisms. Ethereum’s transition to a Proof-of-Stake (PoS) system, known as “The Merge,” drastically altered the landscape of ETH mining. Rather than relying on energy-intensive computation, PoS relies on users staking their existing ETH holdings to validate transactions and secure the network. This transition eliminated the need for traditional mining rigs, impacting the market for specialized hardware. Other cryptocurrencies, such as Dogecoin (DOGE), while maintaining a proof-of-work system, often exhibit lower difficulty and profitability compared to Bitcoin, making them appealing to miners with limited resources or those seeking alternative options.

The profitability of Bitcoin mining hinges on a delicate balance. While the block reward acts as the primary revenue stream, miners also collect transaction fees from the transactions included in each block. These fees fluctuate based on network activity and demand. However, the cost of electricity is a crucial factor eroding profits. Miners seek regions with cheap electricity, often gravitating towards areas with renewable energy sources or hydroelectric power. The capital expenditure of acquiring and maintaining mining rigs also impacts profitability. These machines have a limited lifespan and require regular upgrades to remain competitive. Finally, the operational costs associated with running a mining operation, including cooling, maintenance, and security, contribute to the overall expense.

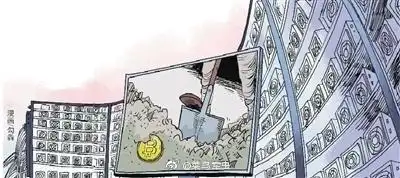

Mining farms, massive data centers dedicated to cryptocurrency mining, represent the industrial scale of this operation. These farms require significant investment in infrastructure, cooling systems, and security measures. They often operate in remote locations with access to cheap electricity and benefit from economies of scale. The future of Bitcoin mining might see a consolidation of power among these large-scale mining farms, potentially raising concerns about centralization within the Bitcoin network. The environmental impact of these energy-intensive operations remains a significant concern, pushing the industry towards more sustainable practices.

Predicting Bitcoin mining profitability in 2025 requires a sophisticated model that accounts for all these variables. While precise forecasts are impossible, analyzing historical trends, projecting future price movements, and assessing technological advancements can provide valuable insights. If Bitcoin’s price continues its upward trajectory, and if energy-efficient mining hardware becomes more readily available, miners might still find profitability, even with increasing difficulty. However, if regulatory pressures mount, or if a bear market ensues, only the most efficient and well-capitalized mining operations will likely survive. Ultimately, the future of Bitcoin mining profitability in 2025 remains an intricate puzzle, with the pieces constantly shifting and rearranging.

The rise of decentralized exchanges (DEXs) and decentralized finance (DeFi) platforms has added another layer of complexity to the cryptocurrency ecosystem. These platforms allow users to trade and lend cryptocurrencies without intermediaries, fostering innovation and potentially impacting the demand for Bitcoin as a store of value. The continued growth and adoption of DeFi could influence Bitcoin’s price and, consequently, the profitability of mining. Furthermore, the emergence of new cryptocurrencies and blockchain technologies poses both opportunities and challenges for Bitcoin miners. Some miners might choose to diversify their operations, mining alternative cryptocurrencies to hedge against the risks associated with Bitcoin’s price volatility. Others might focus on developing innovative solutions that leverage the Bitcoin blockchain, such as layer-two scaling solutions, to enhance its utility and value.