The year 2025 is approaching rapidly, and with it comes a myriad of changes and advancements in the realm of cryptocurrency mining. Bitcoin, being the frontrunner in the crypto space, necessitates an exploration of the top machines that will dominate the mining sector. With increasing competition, regulatory adjustments, and technological breakthroughs, miners must stay informed about the best equipment that can not only keep pace but excel in the evolving landscape.

As the mining difficulty adjusts periodically, the demand for more powerful machines grows. Miners are constantly in pursuit of high hash rates — a critical factor determining the speed and efficiency of mining. In 2025, the leading contenders for the title of the best Bitcoin mining rig will likely feature state-of-the-art ASIC (Application-Specific Integrated Circuit) chips, designed specifically for the task of solving complex calculations inherent in Bitcoin mining.

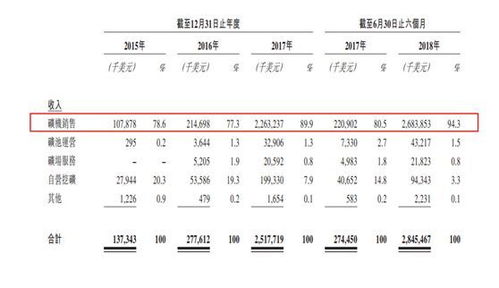

Among the possible contenders are brands like Bitmain’s Antminer series and MicroBT’s Whatsminer. These rigs not only optimize energy consumption but also enhance the hashing performance significantly, thereby facilitating increased profitability. As the competition heats up, understanding the nuances of these machines becomes essential for both amateur and professional miners alike.

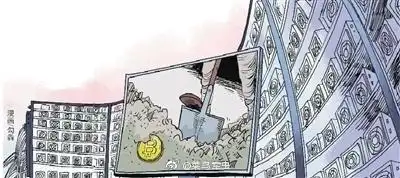

However, merely possessing top-tier mining machines doesn’t guarantee success. The choice between running a solo operation and opting for mining machine hosting can have profound implications. A mining farm offers concentrated power, often resulting in substantial reductions in operational costs per unit of production. By leveraging economies of scale, miners can experience lower electricity rates and efficient cooling solutions, vital for maintaining optimal rig performance.

Moreover, as Bitcoin mining becomes more regulated and scrutinized, choosing a hosting solution that adheres to local regulations becomes increasingly relevant. Compliance not only enhances credibility but also fortifies the legal standing of a mining operation. Miners venturing into the hosting arena must ensure that their chosen facility meets stringent security standards and operational protocols.

On the flip side, enthusiasts who prefer the personal touch might opt for home setups, employing mining rigs tailored to individual needs. This alternative presents its own unique challenges and rewards, necessitating a balance of cost, performance, and operational know-how. The trend of hobbyist mining is expected to witness a surge, especially with the rise of user-friendly interfaces and robust community support.

In the world of cryptocurrencies, diversity holds the key. While Bitcoin remains the crown jewel, altcoins like Ethereum (ETH) and Dogecoin (DOGE) continue to charm investors. Yet, it’s worth noting that miners need to choose their battles wisely — not every cryptocurrency mining operation proves lucrative. The profitability 2025 presents will depend heavily on market trends, regulatory frameworks, and the capacity for various mining rigs to keep up with rapid changes.

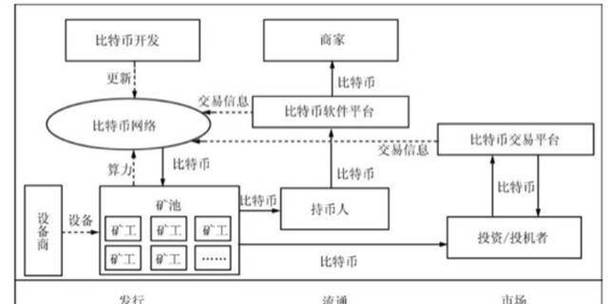

For a deeper understanding, it’s crucial to not only focus on hardware but also establish a solid grasp of the underlying software and mining pools. Successful mining operations often utilize advanced software that efficiently manages resources and facilitates profits. These tools can significantly alter mining dynamics, automating tasks and optimizing performance through intelligent algorithms.

As we enter a new era in cryptocurrency mining, it’s clear that remaining agile and informed is paramount for success. Miners must keep a keen eye on technological advancements, market fluctuations, and community sentiment. The quest to identify the best Bitcoin mining machines in 2025 guarantees a thrilling journey filled with unforeseen challenges and opportunities.

To summarize, while the landscape of Bitcoin mining is on the cusp of transformation, the choices made today will reverberate into the future. Investing in the right mining rigs, embracing effective hosting solutions, and navigating the diverse crypto ecosystem are essential strategies that can pave the way for success in a rapidly evolving industry.