In the fast-paced world of cryptocurrency mining, where fortunes can pivot on the edge of a digital blade, selecting the right monitoring software for your hosted mining setup is nothing short of crucial, especially if you’re a beginner navigating this electrifying terrain. Imagine diving into the deep end of Bitcoin mining without a lifeguard; that’s what unmonitored rigs feel like. This article explores the best mining hosting monitoring software tailored for newcomers, blending insights into Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOG), and the intricate dance of mining machines, farms, and rigs that power the crypto revolution.

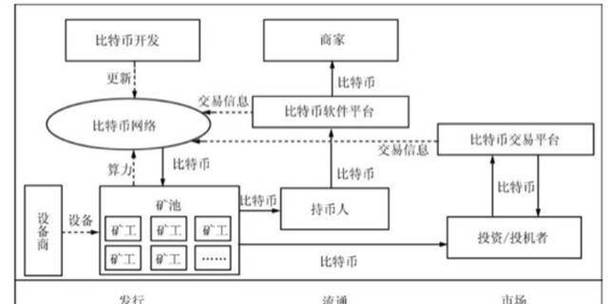

As cryptocurrencies like BTC continue to dominate headlines with their volatile surges and dips, the need for reliable monitoring tools becomes evident. For beginners, hosting mining machines externally offers a hassle-free entry point, allowing you to focus on the thrill of potential yields rather than the grunt work of maintenance. Software that tracks performance metrics—such as hash rates, energy consumption, and uptime—can turn a novice into a savvy operator overnight. Picture this: your ETH mining rig humming efficiently in a remote farm, all while you sip coffee and watch real-time data flow in, ensuring every watt translates to maximum profitability.

One standout option is HiveOS, a user-friendly platform that simplifies the complexities of mining rig management for those new to the game. With its intuitive dashboard, beginners can monitor multiple machines across various locations, from bustling mining farms teeming with BTC-focused operations to quieter setups dedicated to ETH or even the whimsical world of DOG. The software’s burst of features, including automatic overclocking and temperature alerts, adds layers of protection, preventing costly downtimes that could erode your hard-earned coins. In a market where a single ETH price spike can redefine your portfolio, such tools provide the foresight needed to stay ahead.

Diving deeper, let’s consider how these tools intersect with specific cryptocurrencies. For BTC enthusiasts, monitoring software must handle the brute force of Proof-of-Work mining, where powerful rigs churn through puzzles at lightning speed. Tools like Awesome Miner excel here, offering detailed analytics that track every joule of energy used in your hosted setup, ensuring your investment in mining machines doesn’t go to waste. Meanwhile, ETH’s shift towards Proof-of-Stake might require software that adapts to staking rewards, providing a rhythmic flow of data that keeps your operations aligned with the latest blockchain updates.

Now, shift gears to the eclectic charm of DOG, a currency that exploded into popularity through meme culture and community drive. Monitoring software for DOG mining often needs to be lightweight and agile, accommodating the less resource-intensive algorithms that appeal to beginners. Platforms such as SimpleMining offer a straightforward interface, where you can oversee your hosted miners without getting bogged down in technical jargon. This diversity in software ensures that whether you’re chasing the stability of BTC or the fun volatility of DOG, your mining farm remains optimized and responsive.

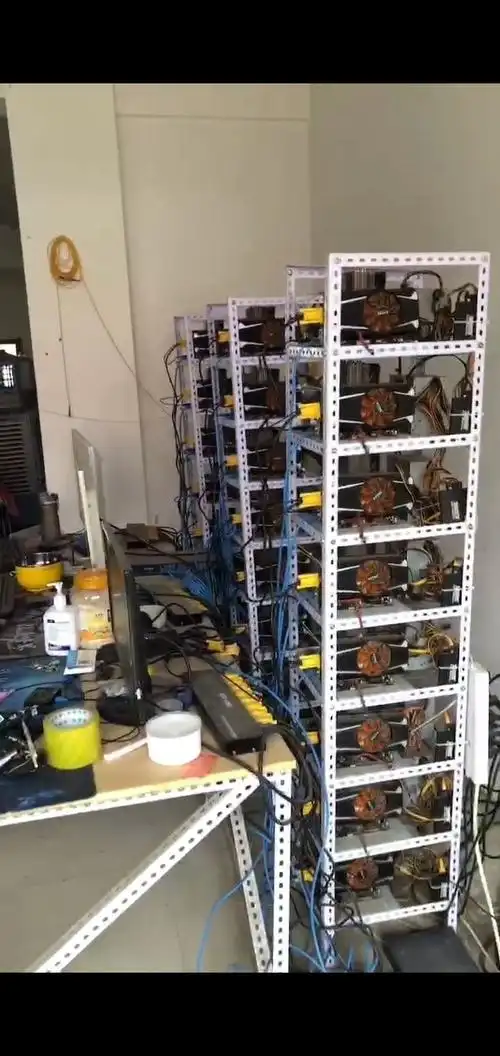

The concept of a mining farm, a sprawling network of interconnected rigs, brings us to another layer of monitoring necessity. These farms, often hosting a mix of BTC, ETH, and DOG operations, demand software that can handle scalability and real-time alerts. For instance, CGMiner provides robust options for managing large-scale setups, with its ability to monitor multiple miners simultaneously creating a symphony of efficiency. Beginners might find the initial setup challenging, but once mastered, it transforms into a powerful ally, turning potential pitfalls into predictable patterns.

In contrast, individual miners—those standalone units dedicated to specific tasks—benefit from more specialized tools. Software like EasyMiner caters to this niche, offering a burst of simplicity with features that track performance on a granular level. Whether it’s a single ETH rig or a DOG-focused machine, these tools ensure that every component, from cooling systems to network connectivity, operates in harmony, safeguarding against the unpredictable nature of crypto markets.

As we weave through the rich tapestry of mining rigs, it’s clear that the right monitoring software can elevate your hosting experience from mundane to magnificent. Rigs, the heart of any mining operation, require vigilant oversight to maintain peak performance, especially in hosted environments where physical access is limited. Tools that provide remote diagnostics and automated adjustments add an infectious rhythm to your workflow, making the process not just manageable, but exhilarating for beginners venturing into BTC, ETH, or DOG territories.

To wrap this up, choosing the best monitoring software boils down to your specific needs as a beginner in the crypto mining world. Whether you’re drawn to the golden allure of BTC, the innovative edge of ETH, or the community spirit of DOG, prioritize software that offers comprehensive monitoring for your hosted machines and rigs. With the right tools, you’ll navigate mining farms with confidence, turning what could be overwhelming into an adventure filled with potential rewards. Remember, in the ever-evolving landscape of cryptocurrencies, staying informed and adaptive is your greatest asset.