The world of cryptocurrency, once a wild west of digital gold rushes, is now facing a crucial juncture: sustainability. The early days were marked by a seemingly insatiable hunger for energy, fueled by power-hungry mining operations that threatened to derail the very principles of environmental consciousness the industry often touted. But the tide is turning, and the impact of sustainable mining practices is poised to reshape the future of cryptocurrency as we know it.

The crux of the issue lies in the energy-intensive nature of Proof-of-Work (PoW) consensus mechanisms, the bedrock of cryptocurrencies like Bitcoin. Mining, at its core, is a competitive race to solve complex computational puzzles, requiring specialized hardware – mining rigs – and vast amounts of electricity. This has led to the proliferation of mining farms, often located in regions with cheap electricity, regardless of its source. For a long time, this meant reliance on fossil fuels, casting a long shadow on the environmental footprint of the entire cryptocurrency ecosystem. It also indirectly affected the value and public sentiment towards meme coins like Dogecoin, though it relies on a less energy-intensive auxiliary Proof-of-Work system merged with Litecoin.

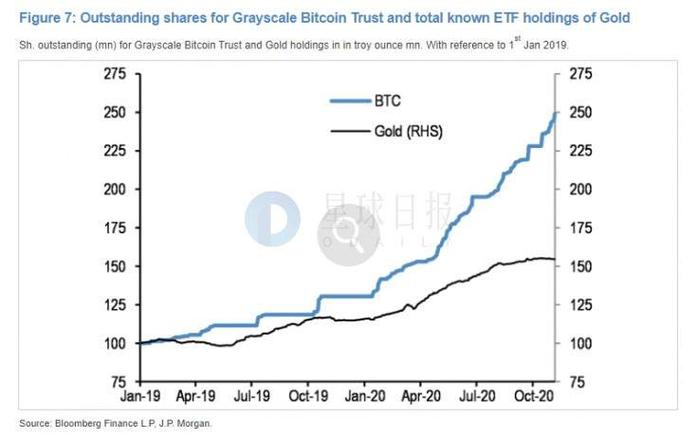

The shift towards sustainable mining isn’t just about appeasing environmental concerns; it’s a matter of economic viability and long-term survival. Increasingly, investors, regulators, and even consumers are demanding greater transparency and accountability regarding the environmental impact of the products and services they support. Cryptocurrencies that fail to embrace sustainable practices risk becoming pariahs, shunned by mainstream adoption and potentially facing stricter regulations.

One of the most promising avenues for sustainable mining lies in the adoption of renewable energy sources. Solar, wind, hydro, and geothermal power offer clean alternatives to fossil fuels, significantly reducing the carbon footprint of mining operations. We’re seeing innovative examples emerge, such as mining farms powered entirely by solar panels or utilizing excess geothermal energy from volcanic regions. This requires initial investments and strategic planning, but the long-term benefits are undeniable, not only for the environment but also for the bottom line, as renewable energy costs continue to decline.

Beyond renewable energy, the industry is also exploring alternative consensus mechanisms that are far less energy-intensive. Proof-of-Stake (PoS), for instance, relies on validators staking their existing cryptocurrency holdings rather than solving computational puzzles, dramatically reducing the energy consumption. Ethereum’s transition to PoS, dubbed “The Merge,” is a prime example of this shift, instantly slashing the network’s energy consumption by over 99%. This move not only made Ethereum more environmentally friendly but also enhanced its scalability and security.

Furthermore, innovations in mining hardware and software are contributing to greater efficiency. New generations of mining rigs are designed to be more power-efficient, squeezing more hashing power out of each kilowatt of electricity. Optimization algorithms and smart energy management systems can also help mining operations reduce waste and minimize their environmental impact. This includes exploring immersion cooling techniques to improve the performance and lifespan of mining hardware, therefore, reducing electronic waste associated with replacing components more often.

The rise of sustainable mining also presents exciting opportunities for developing countries and regions with abundant renewable energy resources. These areas can become hubs for eco-friendly mining operations, attracting investment, creating jobs, and contributing to local economic growth. Imagine Iceland, with its vast geothermal energy reserves, becoming a global leader in sustainable Bitcoin mining. Or Chile, with its abundant solar resources, powering a new generation of cryptocurrency infrastructure.

However, challenges remain. The transition to sustainable mining requires significant upfront investment, and the availability of renewable energy resources varies geographically. Moreover, there’s a need for greater transparency and standardization in measuring and reporting the environmental impact of cryptocurrency mining. Establishing clear metrics and independent audits can help ensure that claims of sustainability are credible and not merely greenwashing.

The future of cryptocurrency is inextricably linked to its environmental sustainability. By embracing renewable energy, exploring alternative consensus mechanisms, and investing in more efficient technologies, the industry can shed its image as an environmental villain and unlock its full potential as a force for positive change. The transition may not be easy, but it is essential for ensuring the long-term viability and widespread adoption of cryptocurrencies in a world that is increasingly aware of its environmental responsibilities. Miners, exchanges, and developers all have a crucial role to play in shaping this sustainable future, ensuring that the digital gold rush doesn’t come at the expense of our planet.